When it comes to your personal finances, there’s nothing as frustrating as finding out that you’re overpaying for something. This frustration can turn to serious worry if you’re overpaying for something as significant as your home. In this article, we identify some warning signs that you might be overpaying for your home, as well as ways to help with housing cost by decreasing your total cost of home ownership.

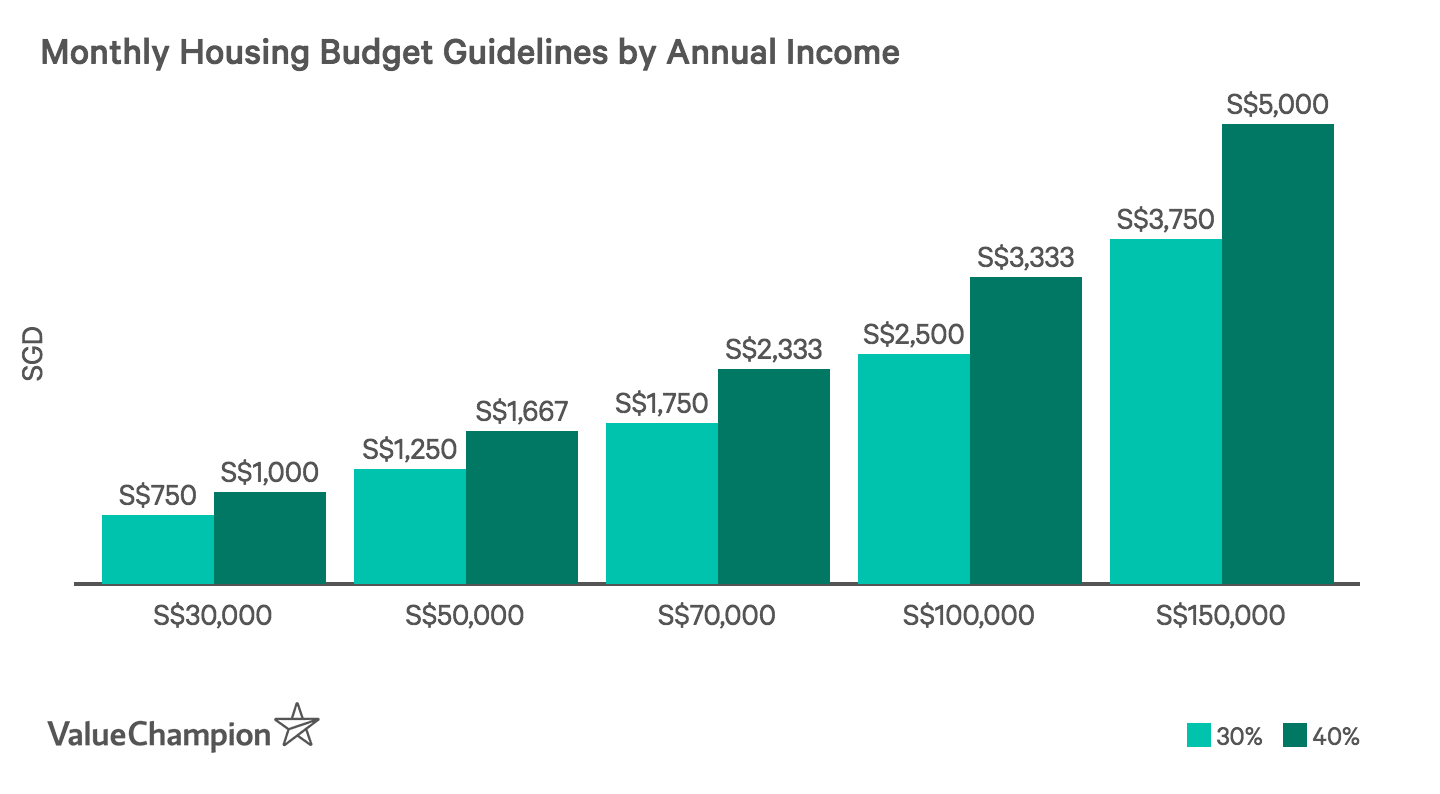

Housing Expenses Exceed 30% of Budget

In general, experts tend to agree that individuals should spend about 30-40% of their income on housing. For homeowners, it is important to make sure that this figure includes not only mortgage payments, but also utility, insurance and maintenance costs. For a household earning S$100,000 annually, this translates to S$1,750 to S$2,333 per month for housing costs. The chart below helps give you an approximate guideline for how much you can afford to spend on your total housing budget.

Image: Value Champion

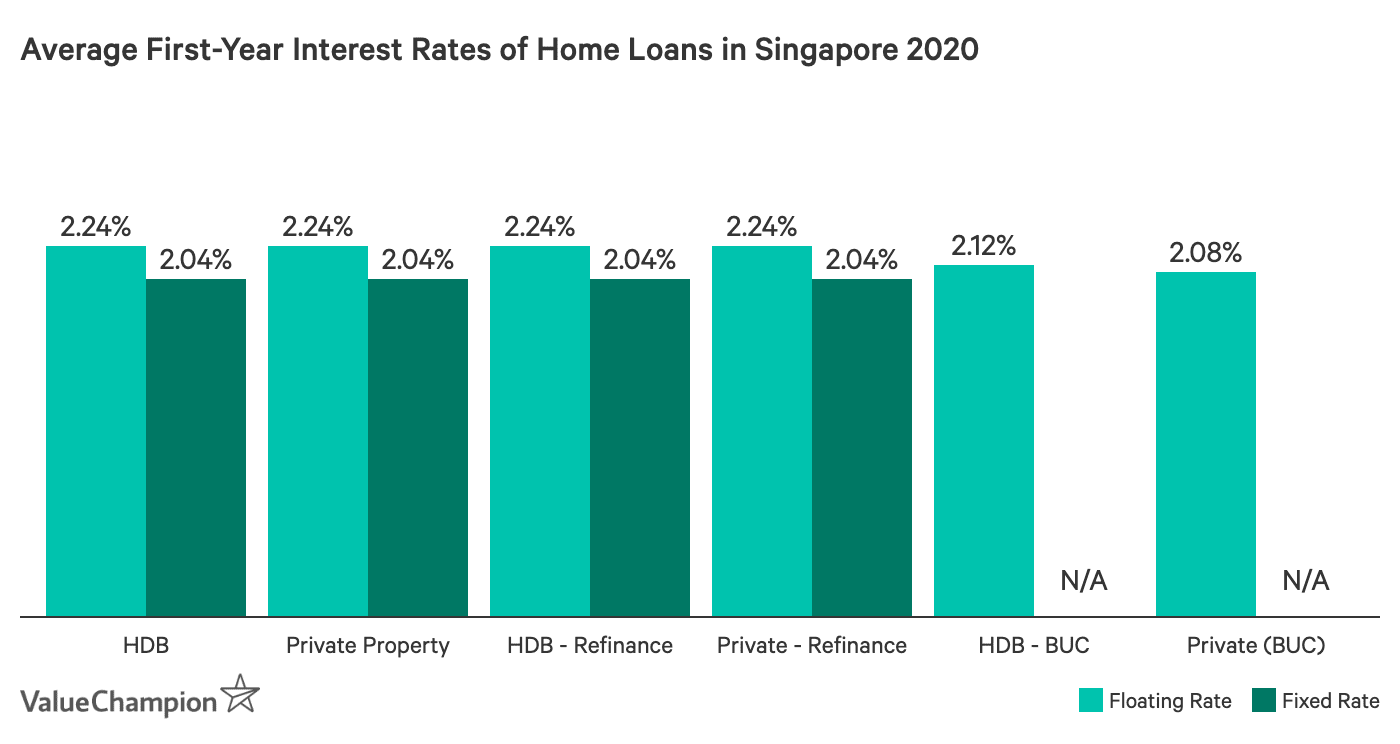

You Didn’t Shop Around for a Home Loan

One reason your housing might be expensive is that your home loan charges a higher than average interest rate. With all of the important decisions to keep track of as a homebuyer, it can be easy to overlook the importance of choosing the right home loan. Even seemingly insignificant interest rate differences can result in huge cost differences in the long-term. For example, a S$500,000, 25-year mortgage with a 3% annual interest rate will cost S$38,392 more than the same loan with a 2.5% annual rate. This translates to monthly payments that are S$128 more expensive. For this reason, it is essential to stay up-to-date with interest rate trends when shopping for a home. Fortunately, ValueChampion makes this simple by offering free guides to demystify home loans in Singapore, supplemented by

live interest rates and product details.

Image: Value Champion

Refinancing Is a Foreign Idea But It Can Help With Housing Cost

There are a number of reasons you might want to refinance your home loan. For example, your mortgage may have started with a low introductory rate, but has become significantly more expensive as the rate has increased. You may also notice that market interest rates are declining and want to take advantage of a lower rate from another lender. Whatever your reason, home loan refinancing can save homeowners a lot of money—if done correctly. For instance, if you have S$400,000 and 20 years remaining on your housing loan, you can save S$96 month or S$1,152 annually by refinancing from an annual interest rate of 2.5% to 2%. These savings will add up, especially for those with many years remaining on their loan. To ensure that you get a good deal, make sure to identify any fees associated with refinancing and make sure to check the

best refinancing rates currently available.

Your Annual Home Insurance Costs More Than S$200

Of course everyone’s home insurance premiums vary depending on the size and value of their home, but in general, the average cost of home insurance for a 4-room HDB flat is about

S$153. This suggests that homeowners in similarly sized flats might be able to cut their insurance bills by comparing prices and benefits of the top home contents insurance plans available. For example, some of the

best plans cost about 60% less than average, while offering similar coverage amounts. Therefore, homeowners that don’t compare their options may be overpaying for their home insurance.

Photo: Value Champion

Still Haven’t Switched Electricity Retailers

If you’ve made it this far and feel like you are not overpaying—congratulations! You’re likely in a great spot financially. However, if you’re still looking for ways to make your home more affordable, you should consider switching electricity providers. According to our research, going with one of the average rates offered by one of Singapore’s electricity retailers

will save you 20-30% compared to SP Group’s rates.

How to Save on Homeownership Costs

While many decisions leading up to the purchase of a new home will dictate the cost of homeownership, it is still possible to get help with housing cost by trimming your expenses once you’ve moved in. Just like any other investment, we urge consumers to conduct their own due diligence about home loan refinancing, home insurance and utility bills. In practice, this means comparing the rates and features of each product using a free resource like ValueChampion, in order to have a better understanding of how individual products compare and to ensure that you get a good deal.

Together Against RSV

Together Against RSV SG60

SG60 Pregnancy

Pregnancy Parenting

Parenting Child

Child Feeding & Nutrition

Feeding & Nutrition Education

Education Lifestyle

Lifestyle Events

Events Holiday Hub

Holiday Hub Aptamil

Aptamil TAP Recommends

TAP Recommends Shopping

Shopping Press Releases

Press Releases Project Sidekicks

Project Sidekicks Community

Community Advertise With Us

Advertise With Us Contact Us

Contact Us VIP

VIP Rewards

Rewards VIP Parents

VIP Parents